Linear regression: prediction and diagnostics

Contents

9.7. Linear regression: prediction and diagnostics#

Let’s refit our linear regression model to our data.

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

states_data = pd.read_csv("data/states_data.csv")

def standard_units(any_numbers):

"Convert any array of numbers to standard units."

return (any_numbers - np.mean(any_numbers))/np.std(any_numbers)

def correlation(t, x, y):

return np.mean(standard_units(t[x])*standard_units(t[y]))

def slope(t, label_x, label_y):

r = correlation(t, label_x, label_y)

return r*np.std(t[label_y])/np.std(t[label_x])

def intercept(t, label_x, label_y):

return np.mean(t[label_y])-\

slope(t, label_x, label_y)*np.mean(t[label_x])

model_slope = slope(states_data, 'cig_tax12', 'smokers12')

model_intercept = intercept(states_data, 'cig_tax12', 'smokers12')

print("intercept...")

print(model_intercept)

print("\n")

print("model slope...")

print(model_slope)

intercept...

23.388876340779785

model slope...

-1.5908929289147922

Simple Prediction#

Now that we have the slope and the intercept, we can provide simple predictions. In particular, if you give me an \(X\) value, I can tell you what the linear regression predicts will be \(Y\) value for that observation. The formula, which is the formula of the line on our graph, is:

So, if the tax per pack is \(\$5\), the predicted percentage of smokers is

or 15.44%. If the tax becomes a subsidy (i.e. it reduces the cost of a pack) of \(\$10\), the predicted percentage of smokers is

or 39.29%. Notice that nothing in the model forces the predictions to be “sensible” (i.e. forces the percentage to be between 0 and 100). For example, if we raise the tax to $17 per packet, our prediction is that the percentage of smokers is

which implies the percentage of the state population that smokes is \(-3.64\)%. And that’s not a possible value. So some care is required when we extrapolate (go far beyond) the current data (in terms of actual \(x\) and \(y\) values).

Just for completeness, here is a simple function that predicts a \(Y\) value for any \(X\) value of interest:

def fit(dframe, x, y):

"""Return the value of the regression line at each x value."""

beta = slope(dframe, x, y)

constant = intercept(dframe, x, y)

return (beta*dframe[x]) + constant

Here we apply the function to our entire dataset just to get the prediction line (the linear regression line) for every observation:

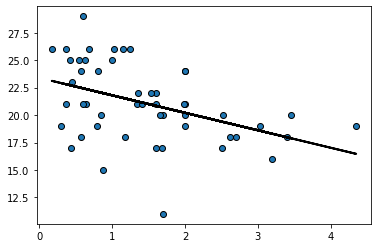

regression_prediction = fit(states_data, 'cig_tax12','smokers12')

plt.scatter(states_data['cig_tax12'], states_data['smokers12'],

edgecolors="black")

plt.plot(states_data['cig_tax12'], regression_prediction,

color="black", linewidth=2)

plt.show()

Residuals#

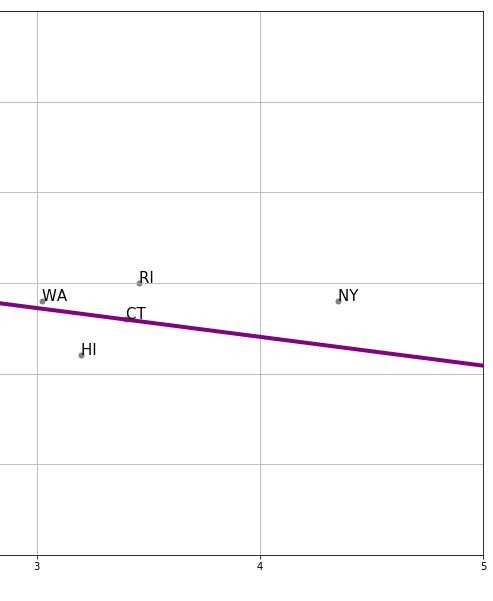

For every actual observation in our data, we have a prediction for it from the regression model. This is what the line tells us, and you can think of it as what we would expect the state’s \(Y\) value to be if our linear model was completely accurate. Take a look at this snippet of our earlier graph, which shows the far right portion of the regression line.

Fig. 9.8 The far right portion of our earlier regression line#

We can see that the actual observation for New York (NY) is above the regression line. Meanwhile, the actual observation for Hawaii (HI) is below the regression line. This tells us that, in some sense, New York’s tax (\(x\)-value) is consistent with a lower smoking percentage than we actually see in that state. Meanwhile, Hawaii’s tax rate is consistent with a higher smoking percentage than we actually see in that state.

In fact, we can be more precise. The actual value for New York’s \(Y\) is 19% (smoking). But the predicted value for New York, sometimes written \(\hat{Y}\) and said “Y-hat” is 16.46. We can write a function to provide this predicted value for any observation we want:

def make_reg_prediction(state="NY"):

states_data['clean_stateid'] = states_data['stateid'].str.strip()

sd = states_data[states_data['clean_stateid']==state]

pred = model_slope*sd['cig_tax12'] + model_intercept

predf = float(pred)

return(predf)

For New York, this is:

make_reg_prediction(state="NY")

16.46849210000044

This brings us to an important term. We can define a residual as being the difference between \(Y\) and \(\hat{Y}\). In particular, the residual for a given observation is

\(Y-\hat{Y}\) for that observation

For New York, the residual is thus: \(19-16.46\), or \(2.54\).

We say this is a positive residual because it is greater than zero. Meanwhile, Hawaii had a negative residual, because this number (\(Y-\hat{Y}\) for Hawaii) was less than zero.

We will use the sum of the squared residuals momentarily, but for now notice that there are some important facts about residuals themselves:

residuals in a regression sum to zero. The intuitive reason is that, if they didn’t—that is, if the positive ones weren’t completely offset by the negative ones—we could alter \(a\) and \(b\) little to get the sum to zero. And that would suggest a better fitting line. Similarly, the residuals are on average zero.

the residuals are uncorrelated with our predictor variable (our \(X\)). This follows from fact 1, but we won’t explore exactly why in this course.

the residuals are informative about model fit. That is, they can tell us how well our straight line describes the data. We will return to this idea below.

Residuals and the best fit line#

In what sense does is our linear regression line the line that fits the data “best”? Well, it is the line that minimizes the all the residuals. Specifically, it is the ordinary least squares line that

minimizes the sum of the squared residuals

For obvious reasons, the ordinary least squares line, and indeed the technique in general, is sometimes referred to by its initials, OLS.

Best fit line#

We are fitting via OLS, which minimizes the sum of squared residuals. Literally, it is finding a value of \(a\) and \(b\) that will minimize (make as small as possible) this sum:

This is another way of describing the residual, above. For a given row of the data, the \(y_i\) is the actual value of the dependent variable. Meanwhile, \(a+bx_i\) is our linear model of that dependent variable. That is, it is the point on the regression line—our prediction—for that observation. But then \(y_i- (a+bx_i)\) is just another way of writing \(y_i-\hat{y_i}\)

The idea is that the sum, \(\sum\), is happening over every row \(i\) in the data. For each observation we have a value of the dependent variable \(y_i\) and the independent variable \(x_i\). So, for the first observation the calculation (the square of the residual) is

this is added to the second squared residual

And so on, down the data. Intuitively, it is as if we are trying out different values of \(a\) and \(b\) until we find the one that minimizes that sum. Indeed, a linear model that fits perfectly would have \(y_i\) equal to \(a+bx_i\) for all observations and thus the sum would be zero.

Now, in fact, we don’t literally try each possible value of \(a\) and \(b\)—there is a matrix algebra solution that finds the minimum very quickly. Notice that this solution will be unique: there is only one best fit line possible for a given linear regression problem.

Residuals and diagnostics#

As the logic above suggests, it is straightforward to calculate the residual for any given observation. Ideally, we would like these residuals to be approximately the same size, no matter what the particular value of \(X\). This is equivalent to saying we want the spread of the residuals to look similar throughout the data. We call that spread of the residuals the error variance.

Another way to put this is that we don’t want the line to fit systematically better for some values of \(X\) and worse for others. If it does, i.e. if the nature of the residuals changes as \(X\) increases or decreases, we have evidence of non-constant error variance, which sometimes goes by the name heteroscedasticity.

The consequences of heteroscedasticity are twofold from our perspective:

first, it can generate problems with interpreting coefficients. In particular, it can lead to make type-I or type-II errors when declaring that a specific coefficient (so the \(b\) for a specific variable) is “statistically significant” or not

second, it is emblematic of a specification error. That is, non-constant error variance potentially tells that a linear regression is not appropriate, and perhaps we should have allowed for a non-linear model (line) through our data instead.

To get a sense of the diagnosis procedure, let’s start by writing a simple function to calculate the residuals for a given regression of \(y\) on \(x\) (this uses the fit() function above):

def residual(dframe, x, y):

return dframe[y] - fit(dframe, x, y)

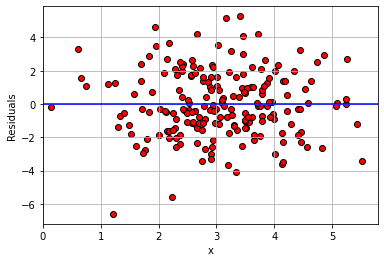

To get a sense of how constant error variance looks, we can generate some (fake) data which we know does not suffer from heteroscedasticity. We won’t belabor the details, but we make our \(x\) variable to be 200 random draws from a normal distribution, and our \(y\) variable to be 200 random draws from a different normal distribution. Then we will put these in a data frame and call the residual function from the regression of the (fake) \(y\) on the (fake) \(x\).

np.random.seed(5)

fake_x = np.random.normal(3,1, 200)

fake_y = np.random.normal(2,2, 200)

fake_data = pd.DataFrame().assign(x=fake_x, y=fake_y)

perfect_residuals = residual(fake_data, 'x', 'y')

Now, we just want to plot these (fake) residuals in terms of the value of the predictor variable on the \(x\)-axis, versus the value of the residuals themselves on the \(y\)-axis. They should a mean of zero, but importantly, they should also be spread above and below the line to roughly the same degree whatever the value of \(x\).

plt.scatter(fake_data['x'], perfect_residuals,

color="red", edgecolors="black")

plt.ylabel("Residuals")

plt.xlabel("x")

plt.xlim(0, None)

plt.axhline(0, color="blue")

plt.grid()

plt.show()

That is approximately what we see: as we move from low values of \(x\) (so, zero or one) to high values of \(x\) (so, four or five), the variance of the red dots around the blue zero line doesn’t change very much. This is constant error variance.

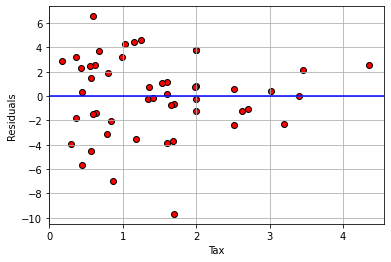

What about for our regression above?

model_residuals = residual(states_data, "cig_tax12", "smokers12")

plt.scatter(states_data['cig_tax12'],

model_residuals, color="red", edgecolors="black")

plt.ylabel("Residuals")

plt.xlabel("Tax")

plt.xlim(0, None)

plt.axhline(0, color="blue")

plt.grid()

plt.show()

Here, the error variance for low values of the tax variable are more evenly spread than for high values. And, for high tax states, the residuals are smaller. This suggests our model does a better job of fitting the observations for high-tax states. In general then, it seems we may have some non-constant error variance.

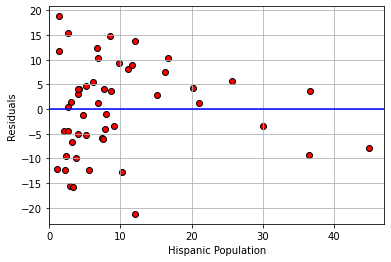

For an even sharper example, consider a regression of the percentage of a state’s population that is pro-Choice (prochoice) on its proportion of Hispanic residents (hispanic08).

model2_residuals = residual(states_data, 'hispanic08', 'prochoice')

plt.scatter(states_data['hispanic08'],

model2_residuals, color="red", edgecolors="black")

plt.ylabel("Residuals")

plt.xlabel("Hispanic Population")

plt.xlim(0, None)

plt.axhline(0, color="blue")

plt.grid()

plt.show()

We see something quite different here. For low Hispanic population values, the error variance looks somewhat constant. But for mid-levels, the residuals are mostly above the line (we underpredict for these states). For relatively large values of Hispanic population, the residuals are mostly below the line (we overpredict for these states). This suggests that \(y\) might not be linear in \(x\) and that a different model is called for.

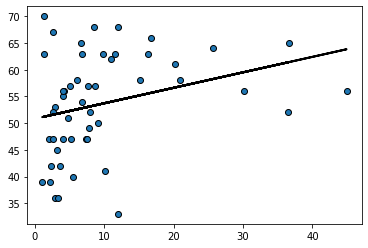

Indeed, looking at the regression line for this example suggests it should perhaps be more of a curve:

regression_prediction2 = fit(states_data, 'hispanic08','prochoice')

plt.scatter(states_data['hispanic08'], states_data['prochoice'],

edgecolors="black")

plt.plot(states_data['hispanic08'], regression_prediction2,

color="black", linewidth=2)

plt.show()

Model fit#

How well does our regression fit our data? One common way to think about it is in terms of the amount of variation in \(y\) (the thing we are trying to predict) that is explained by our linear model that uses \(x\). When this number is large, we are saying that, overall, we can predict \(y\) very well using our model; when it is small, we are saying that, overall, we cannot predict \(y\) very well using our model.

The particular measure we will use is called R-squared or R-square or \(\mathbf{R^2}\). It is

the proportion of the variance in the outcome (\(y\)) that our linear regression explains; and it is the square of the correlation between \(x\) and \(y\).

Perhaps unsurprisingly, when \(x\) and \(y\) are highly correlated (\(r_{XY}\) is large), we expect to do a better job of predicting \(y\) from \(x\) and the model.

As with the slope and the intercept, there are many ways to calculate \(R^2\). We will use this method:

From the formula, we can see that when the variance of the fitted values is the same as the variance of \(y\), then \(R^2\) will be one, which is the highest it can be. By contrast, if the fitted values don’t have any variance – meaning we are predicting the same value of \(y\) for every \(x\) – then \(R^2\) is zero, which is the worst-fitting model possible.

The fact that \(R^2\) is just the correlation squared makes it easy to write a function for:

def r2(t, x, y):

return correlation(t, x, y)**2

Applied to our model, we see that proportion of variance explained is about 0.19 (19% of the variance in \(Y\) is explained by our model).

r2(states_data, "cig_tax12", "smokers12")

0.18619559936896055